Surcharge Payments Without the Processing Fees – Done Right

For local and online retail businesses

Ready to Get Started?

Submit your information by completing our simple form and we will contact you with 24 hours tocomplete your application.

Compliant Credit Card Surcharge Payment Program

Looking to offset your processing fees but still have the same security accepting credit cards? So you still earn 100% of your published prices, GCS Funding is your Compliant credit card surcharge payment program that will recoup the cost assicated with non-cash paying customers while meeting all Federal and State regulations.

What is a Surcharge and how does it work?

Traditional credit card processing the merchant would absorb the fees as a cost of doing business to gain their customers loyalty. With Surcharge this allows the merchant to offset the cost of the processing by the user pays a 3.5% program fee, this helps you retain more revenue and see 100% of your sale.

PROGRAM PERKS

Increase Revenue

Save thousand of dollars annually by recouping credit card processing cost from your customers. See the cost savings every month on your statement of the revenue that you are now gaining instead of spending.

PCI-Compliant Software and Equipment

Using the latest in technology with fully integrated terminals, VT and gateways you can accept payment anywhere.

Peace of Mind

Ensure accuracy with our intelligent, surcharge-enabled devices and software that will calculate and apply the correct amount on eligible transaction and avoid accidental mistakes.

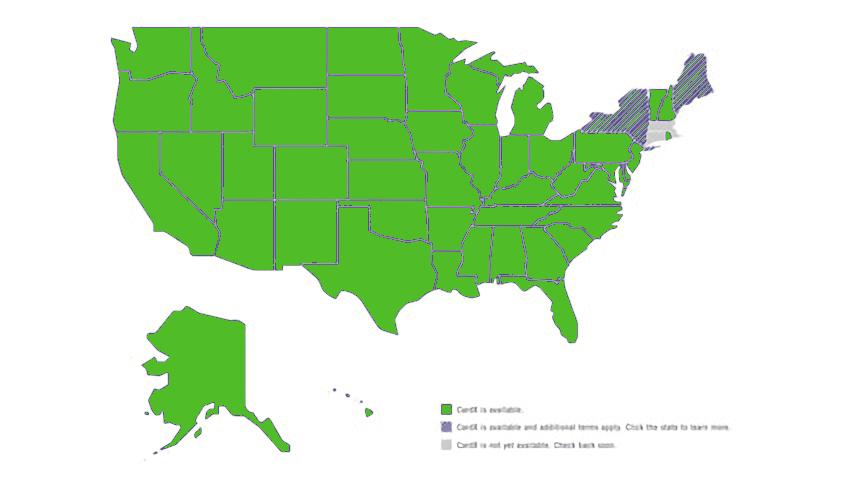

Exceeds Federal and State Requirements

Ensuring you accepting all transactions that exceeds all federal and state regulations for compliance.

PROGRAM RULES

Card Branding

The merchant must be registered with the card brand.

Disclosure

The merchant must inform their customers of the credit card fee with appropriate signage at the location or site.

Guidelines

)The amount of the credit card fee must not exceed 4% and the merchant must not profit from the credit card fee. (We will charge the 3.5% credit card fee and you will receive 100% of your sale.)

Processing

The credit card fee and the price of the sale or service must be processed together as one transaction.

HOW IT WORKS

Payment entered into a Terminal or Virtual Terminal

The merchant accepts payment for the set dollar amount.

Customer payment is processed

The transaction will go through on the smart terminal charging the customer a 3.5% surcharge on their credit card transaction.

A receipt of transaction is generated

The 3.5% surcharge payment covers the merchants credit card processing fees, and is reflected on the customers receipt.

Full amount of sale deposited to your account

100% of purchase price deposited into merchants account

Get Started

Get in Touch

CONTACT GCS FUNDING

(480) 764-3863